How VR Is Being Utilized in the Finance Industry

Enhancing Financial Education and Training

If you want to enhance your financial education and training, virtual reality (VR) can be a valuable tool. With VR technology, you can immerse yourself in lifelike financial scenarios and gain practical experience without the risk of real-world consequences. Imagine being able to step into a virtual trading floor and practice making investment decisions in real-time.

VR can provide you with a safe and interactive environment to learn about various financial concepts, such as stock trading, risk management, and portfolio diversification. Through VR simulations, you can explore different market conditions and experience the impact of your decisions firsthand. This hands-on approach can help you develop critical thinking skills and improve your ability to make informed financial choices.

VR can also be used to simulate financial crises, allowing you to learn how to navigate through challenging economic situations. By engaging with these simulations, you can learn from your mistakes and refine your financial strategies.

Moreover, VR can provide access to expert-led training programs and workshops. You can attend virtual seminars and interact with industry professionals, gaining valuable insights and networking opportunities. VR platforms can also offer interactive tutorials and educational resources, making it easier to grasp complex financial concepts.

Virtual Trading Floors: Simulating Real-World Market Conditions

By simulating real-world market conditions, virtual trading floors provide you with an immersive and realistic experience in the finance industry. These virtual platforms are revolutionizing the way traders learn and practice their skills.

Here are four key features of virtual trading floors:

- Real-time market data: Virtual trading floors provide access to live market data, allowing you to track real-time price movements and make informed trading decisions. This feature helps you develop a better understanding of market dynamics and enhances your ability to react quickly to changing conditions.

- Risk-free trading: With virtual trading floors, you can practice trading without risking your own capital. This feature allows you to experiment with different strategies, test your trading skills, and gain confidence before entering the real market.

- Interactive trading tools: Virtual trading floors offer a range of interactive tools, such as charting software, order entry systems, and portfolio management tools. These tools enable you to analyze market trends, execute trades, and manage your virtual portfolio effectively.

- Collaboration and competition: Virtual trading floors often provide a social component that allows you to interact with other traders. You can join trading communities, compete in trading competitions, and learn from experienced traders. This collaborative environment fosters learning and helps you stay updated with the latest market trends.

Virtual trading floors aren’t only changing the way traders learn and practice, but they’re also providing a safe and efficient environment for professionals to test new strategies and refine their skills. With their immersive experience and realistic market simulations, virtual trading floors are becoming an essential tool in the finance industry.

Metaverse In The Fintech Industry

Metaverse in the Fintech Industry holds the promise of a transformative synergy. As financial technology continuously evolves, the metaverse emerges as a powerful tool for financial institutions. By integrating the metaverse into fintech, users can expect a seamless and immersive banking experience, from virtual branches and financial consultations in virtual worlds to secure, decentralized blockchain transactions. Smart contracts and NFTs could revolutionize ownership and digital asset management. Moreover, the metaverse offers an opportunity for financial education and inclusivity, making complex financial concepts more accessible and engaging for a wider audience. In this way, the metaverse presents novel avenues for fintech to connect with users in unprecedented ways, creating a dynamic, futuristic, and user-centric financial ecosystem.

Immersive Data Visualization: A New Perspective on Financial Analysis

Experience financial analysis from a whole new perspective with immersive data visualization. In the finance industry, where numbers and figures play a crucial role, the ability to visualize data in a meaningful way is essential. Virtual reality (VR) technology is revolutionizing the way financial professionals analyze and interpret data by providing them with immersive and interactive visualizations.

Through VR, you can now step into a virtual world where complex financial data is transformed into vibrant and dynamic visual representations. Imagine wearing a VR headset and being surrounded by a three-dimensional environment that visualizes financial data in real-time. You can explore different dimensions of the data by moving around, zooming in, or even interacting with the visualizations.

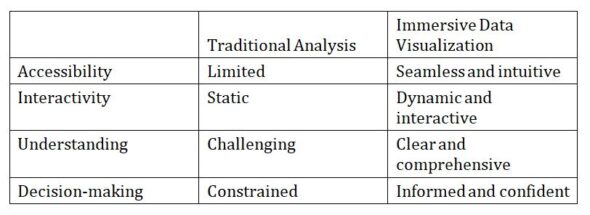

To give you a better idea, here’s a sample table showcasing how immersive data visualization can enhance financial analysis:

Virtual Branches: Transforming the Banking Experience

As you step into the world of virtual reality, you’ll witness how virtual branches are transforming the banking experience. With the rapid advancements in technology, banks are now leveraging virtual reality to bring convenience and innovation to their customers.

Here are four exciting ways virtual branches are revolutionizing the banking industry:

- Enhanced accessibility: Virtual branches eliminate the need for physical visits to the bank, allowing customers to access banking services from the comfort of their own homes. Whether it’s opening an account, applying for a loan, or even resolving a query, virtual branches make banking more accessible than ever before.

- Personalized interactions: Through virtual branches, banks can provide personalized and immersive experiences to their customers. Virtual reality technology enables real-time interactions with virtual bankers, creating a more engaging and tailored banking experience.

- Time and cost savings: Virtual branches eliminate the need for customers to commute to physical bank branches, saving them valuable time and money. Additionally, banks can reduce their operational costs by utilizing virtual branches, leading to more efficient service delivery.

- Increased security: Virtual branches offer enhanced security measures to protect customers’ financial information. With features like multi-factor authentication and secure data encryption, virtual branches provide a safer environment for conducting banking transactions.

Virtual branches are transforming the way we bank, making it more convenient, personalized, and secure. Embracing virtual reality technology, banks are shaping the future of banking by bringing the branch experience directly to their customers, anytime and anywhere.

Virtual Reality for Wealth Management: Personalized Investment Advice

Get ready to dive into the world of virtual reality for wealth management, where you can receive personalized investment advice like never before.

Virtual reality (VR) technology is revolutionizing the way wealth management is conducted by providing a unique and immersive experience for investors.

With VR, you can enter a virtual environment where you can interact with financial experts and receive tailored investment advice based on your individual goals and risk tolerance. Through realistic simulations and data visualization, you can gain a better understanding of complex financial concepts and make more informed investment decisions.

One of the key advantages of VR for wealth management is the ability to personalize the advice and recommendations you receive. By analyzing your financial data and preferences, VR platforms can generate customized investment strategies that align with your specific needs and objectives. This level of personalization goes beyond what traditional wealth management services can offer, as it takes into account your unique circumstances and goals.

Additionally, VR for wealth management allows you to experience different investment scenarios in a virtual setting. You can explore the potential outcomes of various investment choices and adjust your strategy accordingly, all within a safe and controlled environment. This empowers you to make well-informed decisions and mitigate potential risks before committing your actual funds.

In conclusion, virtual reality is transforming the world of wealth management by providing personalized investment advice that’s tailored to your individual needs and preferences. With VR, you can gain a deeper understanding of financial concepts, make more informed decisions, and experiment with different investment strategies.

Embrace the power of VR and take control of your financial future like never before.

VR in Fraud Prevention: Strengthening Security Measures

You can now actively use VR technology to strengthen security measures and prevent fraud in the finance industry. Virtual Reality is revolutionizing the way fraud prevention is approached, providing a more immersive and realistic training experience for professionals.

Here are four ways in which VR is being utilized to enhance security measures:

- Simulating Real-Life Scenarios: VR allows financial institutions to create realistic simulations of potential fraud situations, enabling employees to practice identifying and responding to threats in a risk-free environment.

- Improving Employee Training: By incorporating VR into training programs, employees can engage in interactive and hands-on experiences that enhance their understanding of fraud prevention techniques, making them more prepared to detect and prevent fraudulent activities.

- Enhancing Risk Assessment: VR technology can assist in analyzing large sets of data and identifying patterns that could indicate potential fraud. This helps financial institutions to proactively identify and mitigate risks before they escalate.

- Strengthening Customer Authentication: VR can be used to create secure and immersive authentication methods, such as using biometric data or facial recognition, ensuring a more robust and reliable verification process for customers.

With the integration of VR, the finance industry can bolster its security measures and stay one step ahead of fraudsters, safeguarding both the institution and its customers.

Conclusion

In conclusion, VR is revolutionizing the finance industry by enhancing financial education and training, simulating real-world market conditions, and providing immersive data visualization.

Additionally, VR is transforming the banking experience through virtual branches, offering personalized investment advice in wealth management, and strengthening security measures in fraud prevention.

With the use of VR technology, the finance industry is able to offer innovative and interactive solutions that improve efficiency, accuracy, and customer satisfaction.

Embracing VR is crucial for staying competitive in the evolving financial landscape.

No Comments